A case against two brothers accused of exploiting Ethereum MEV bots collapsed into a mistrial after jurors were brought to tears. At first, I thought prosecutors might use the mistrial as an excuse to drop the charges, now that Trump has declared crypto enforcement off-limits.

But it seems prosecutors intend to re-try the case, demonstrating how Trump’s professed pro-crypto, anti-“regulation by enforcement” shift only seems to benefit the wealthy and well-connected. Cases against smaller crypto- and privacy-software developers, meanwhile, have continued unabated.

#crypto #cryptocurrency #USpolitics #USpol #CitationNeededNewsletter

![Screenshot: January 26, 2025 tweet by Roger Ver: “Mr. President, I am an American, and I need your help. Only you, with your commitment to justice, can save me @realDonald Trump”. Below is a video, paused on a frame with Ver staring off into the distance, with a waving American flag superimposed atop

But simultaneously, the Justice Department has continued to aggressively prosecute Roman Storm, a developer of the Tornado Cash cryptocurrency mixing software who received a mixed verdict in his August trial [I90]. The agency recently pursued the maximum sentence against the developers of Samourai Wallet, another crypto mixing service [I96]. And now, rather than dropping the charges, prosecutors have asked for a new trial date to take another swing at convicting the MEV brothers, who face up to 20 years in prison if convicted.](https://media.hachyderm.io/media_attachments/files/115/578/724/014/176/733/original/765ca58b61e83672.png)

![Despite its professed shift, the Trump-era DOJ has been erratic on crypto enforcement. In statements and in select cases — especially those involving wealthy, well-connected players — it has appeared lenient. It dropped an investigation into crypto prediction market platform Polymarket [I89]. It’s looking to settle a major tax evasion case against Roger Ver, a wealthy crypto investor who in January published a video plea to Trump for leniency, complete with waving flags, a dramatized enactment of Ver being arrested, and Ver insisting “I am an American, and I will die an American” (Ver renounced his US citizenship in 2014 in hopes of avoiding taxes on his crypto gains, though he now says it was to escape “lawfare” from the US government) [I57, 91, 95]. The department has also said it won’t prosecute developers who write crypto software “without ill-intent” even if they fail to register as money transmitters.13 And Trump himself rebuked the Biden-era DOJ by pardoning Binance founder Changpeng Zhao, framing relief for a man alleged to have deliberately evaded US regulations to profit from American customers as a stand against a “war on crypto”.](https://media.hachyderm.io/media_attachments/files/115/578/717/314/771/442/original/0a2bd0a0e6a26a50.png)

![I originally wondered if the mistrial might give the prosecutors an easy excuse to drop the case. In addition to being highly technical and challenging to explain to a jury, there are genuine questions around whether the brothers were defrauding bot operators who in turn were making automated trades that often disadvantage humans they’re trading against or if they were simply out-trading those bots in a largely lawless ecosystem where it’s expected there will be winners and losers. But the original charges were brought in 2024, by a Biden-era Justice Department from which Trump’s DOJ has been eager to distance itself — particularly when it comes to crypto-related cases. An April 2025 memo from Deputy Attorney General Todd Blanche condemned the Biden-era DOJ’s approach to crypto, deeming it a “reckless strategy of regulation by prosecution, which was ill conceived and poorly executed”. In the memo, he outlined new DOJ priorities aligned with Trump’s directive to support the crypto industry, dismantled the National Cryptocurrency Enforcement Team, and directed the Criminal Division’s Market Integrity and Major Frauds Unit to halt cryptocurrency enforcement [I81].](https://media.hachyderm.io/media_attachments/files/115/578/711/003/652/959/original/0a768c0eff9929f2.png)

![The project is being developed with the Saudi company Dar Global, continuing the now-familiar pattern of lucrative Trump administration and family deals with Persian Gulf governments and companies. Congressional and public outcry over apparent corruption and ethics violations involving a $2 billion UAE investment in Binance denominated in the Trump family’s stablecoin (which would route tens of millions in interest on the reserves to the Trumps) [I83], a White House–brokered AI-chips deal with the UAE [I93], and another White House deal granting the UAE a 15% stake in TikTok [I94] evidently have not slowed Trump’s pursuit of similar arrangements.](https://media.hachyderm.io/media_attachments/files/115/578/698/274/694/024/original/18fcd813ed366721.png)

![Trump business interests

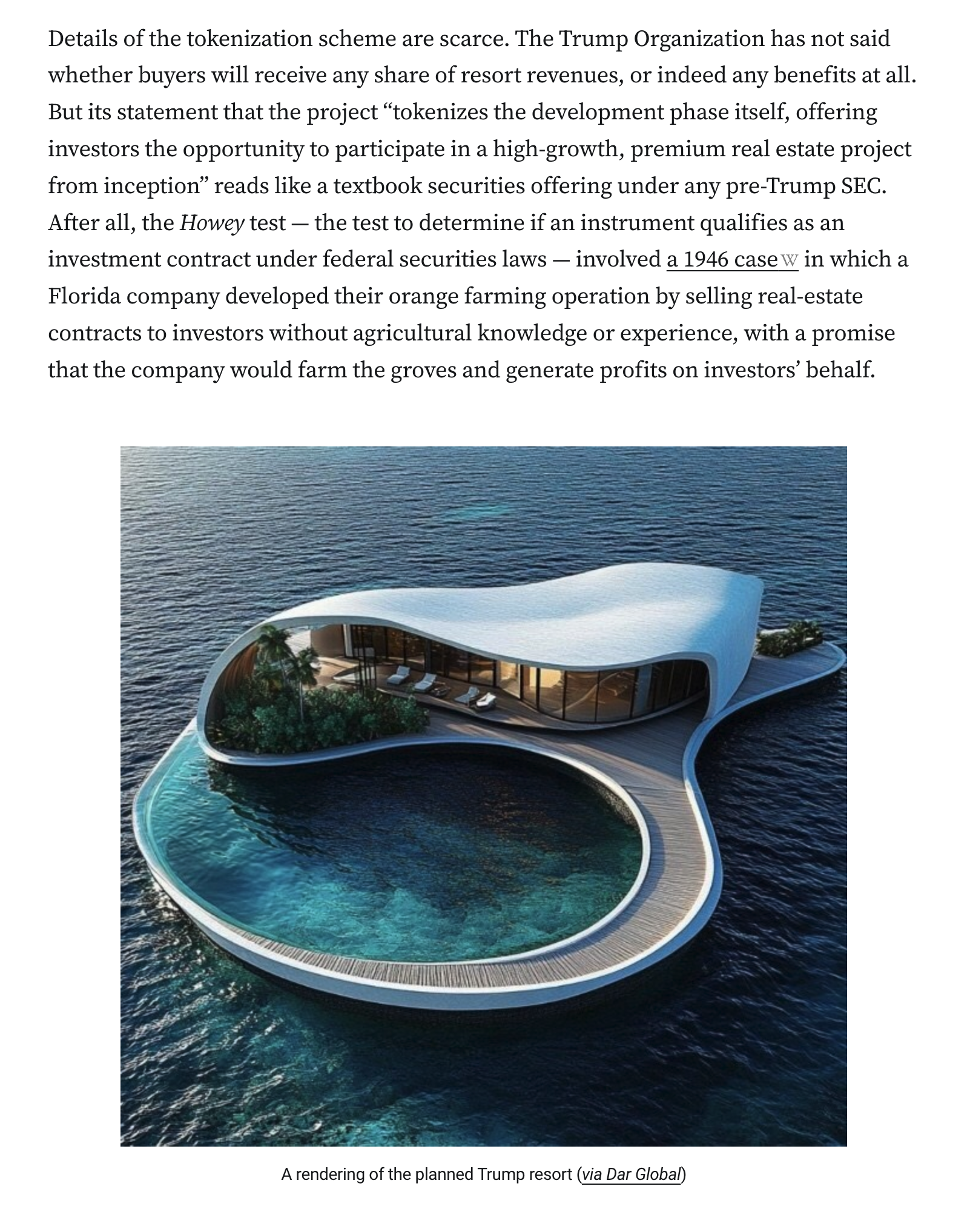

Newest on President Trump’s rapidly expanding list of crypto ventures is a Trump-branded hotel and resort in the Maldives, which the Trump Organization says will be financed by “tokenizing” the project’s construction phase on a blockchain and selling the tokens to US retail investors.34 The Trump sons and some of their crypto business partners have lately been eagerly pitching the idea of new projects involving both real estate and blockchains [I94], which they present as an opportunity for retail investors who they claim have been unfairly excluded from high-risk real estate investments — rather than what it plainly is: an opportunity for Trump to start bilking everyday people as well as institutional lenders, contractors, and laborers.](https://media.hachyderm.io/media_attachments/files/115/578/697/407/860/872/original/c54a7ced01241857.png)

![Tornado Cash

The prosecution of Tornado Cash developer Roman Storm has been controversial among crypto enthusiasts and privacy advocates [Tornado, Tornado 2]. Initiated under Biden, the Trump DOJ nevertheless took the case to trial, infuriated those who hoped Trump’s crypto pivot would protect those in the space without as much influence — not just his deep-pocketed benefactors. Prosecutors eked out a conviction on one charge while the jury deadlocked on the two more serious charges.

Weeks later, Assistant Attorney General Matthew Galeotti told a crypto conference that “merely writing code, without ill-intent, is not a crime,” which some took as a signal the DOJ might retreat from the unpopular case. Instead, the agency filed a sprawling brief opposing Storm’s motion for acquittal [I94], urging the judge to uphold the one conviction, and insisting that a reasonable jury would have convicted him on the other two. Prosecutors haven’t yet said whether they’ll retry those charges, but the force of their filing suggests to me that they don’t intend to stand down.14](https://media.hachyderm.io/media_attachments/files/115/578/734/794/539/595/original/b161ff2c7006537c.png)